Health Insurance Coverage for Knee Replacement Surgery

Navigating Health Insurance for Knee Replacement Procedures

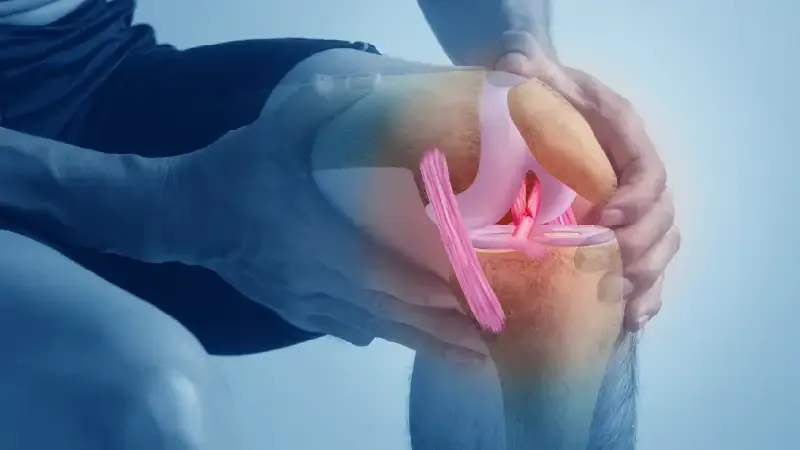

The knee is one of the largest joints in our body, which allows us to walk, run, jump and be flexible. Having a healthy knee is often a concern for all of us. In the modern world, individuals avoid physical activity and choose to stay in their comfort zone. Today, everything is easily accessible, such as the delivery of food, gadgets, and everyday items to our doorsteps.

Smartphones have made interactions among ourselves easier, limiting our movements. Most senior citizens and obese individuals may complain of pains in their joints, muscles and knees. So, as the knee weakens, you may need to undergo a surgical procedure known as knee arthroplasty or knee replacement surgery. Before opting for the surgery, it is crucial to get the right counselling from your physician. However, choosing the best knee replacement insurance coverage to get adequate financial support during critical moments is also equally important.

Is Knee Replacement Surgery successful in India?

The success rate of Knee Replacement Surgery in India is close to 100%. There are very few cases recorded that posed complications post-surgery, but none were prolonged.

Your orthopaedic surgeon will always try other measures before suggesting a knee replacement. If your symptoms are still manageable, then you may prefer to wait. Your surgeon can advise you on the surgical options, the potential pros and cons of the surgery, and the effects of the delays. These suggestions are confined to your age, health and level of activity. Individuals also look for health insurance that covers orthopaedic surgery for safety.

What will the cost of knee replacement surgery be in India?

The Knee Replacement Surgery cost in India is usually between Rs. 1.5 lakh and Rs. 2.3 lakh. However, the prices may vary depending on the hospitals in your city. The final hospital bill depends on certain factors –

- The number of days spent in the hospital. It depends on whether your knee replacement is total, partial or bilateral. The treatment could differ for each of these types.

- The type of surgical procedure and the implants used. It includes the use of specialised computer technology and implant material. You may consult your doctor about the surgical method that is most suitable for you before undergoing surgery.

- Pre-existing conditions involve extra care in the hospital or additional precautions before going into surgery.

- Time spent in the operating room. If the damage is complex or critical, it takes longer to operate. Alternatively, your doctor could use advanced technology on the surgical table, which can cost you more.

Many ask, which health insurance cover knee replacement for financial relief? The good news is that several health insurance plans have knee replacement surgery in their coverage.

Benefits of a Health Insurance Cover for a Knee Replacement Surgery

Knee Replacement Surgery might become necessary for an individual with severe complications, irrespective of their age. The knee implants used in Knee Replacement Surgery are quite expensive and mostly imported from foreign countries. With the rising cost of health care, you need to think about the cost of hospital stays, surgeon fees, medical costs, and the taxes imposed on imported implants. Hence, one can stay wise and consider health insurance that covers the cost of knee replacement surgery.

Star Health and Allied Insurance offer you a set of health plans that cover Knee Replacement Insurance. Some of the plans where Knee Replacement Surgeries are covered have been listed below:

1. Super Star Health Insurance Policy

Star Health’s Super Star plan is a unique and comprehensive health insurance plan that is designed to meet all your needs at every stage of life. It offers an unlimited sum insured option and up to 21 optional covers, ensuring that you and your loved ones have complete protection and peace of mind. Some of its benefits include customisable coverage, advanced treatment options, maternity benefits, wellness rewards and more. This plan is available for individuals of all ages, and the freeze your age benefit can be opted for by anyone entering the policy up to 50 years, allowing policyholders to save their premiums based on their entry age until a claim is made, leading to significant savings over time.

2. Family Health Optima Insurance Plan

Family Health Optima Insurance plan offers extensive coverage to the entire family at affordable premiums. The coverage of this plan is for the age group of 18-65 years. Newborns are covered from the 16th day. Pre-existing diseases are covered after 48 months of continuous insurance without any breaks during the renewal.

The claims also include charges of pre- and post-hospitalisation, emergency medical evacuation, reimbursement of air transportation, repatriation of mortal remains and so on. Also, the customers can gain a no-claim bonus for every claim-free year.

3. Comprehensive Insurance Plan

The Star Comprehensive Insurance plan covers all the family members under a single sum insured amount. People in the age group 18-65 years are covered under this plan. Dependant children coverage starts from 3 months to 25 years of age.

The policy offers broad coverage, which includes expenses of in-patient hospitalisation, domiciliary hospitalisation, AYUSH treatment, delivery and newborn baby expenses, and many more benefits. As an added advantage, you can also claim a no-claim bonus for every claim-free year. Additional benefits like outpatient consultation for dental/ophthalmic treatments once a block every three years are also covered.

HELP CENTRE

Confused? We’ve got the answers

We're Star Health. We offer the coverage that's designed to help keep you healthy. It's the care that comes to you and stays with you.

People Also Search For

Health Insurance Coverage for pre-existing medical conditions is subject to underwriting review and may involve additional requirements, loadings, or exclusions. Please disclose your medical history in the proposal form for a personalised assessment.

The information provided on this page is for general informational purposes only. Availability and terms of health insurance plans may vary based on geographic location and other factors. Consult a licensed insurance agent or professional for specific advice. T&C Apply. For further detailed information or inquiries, feel free to reach out via email at marketing.d2c@starhealth.in